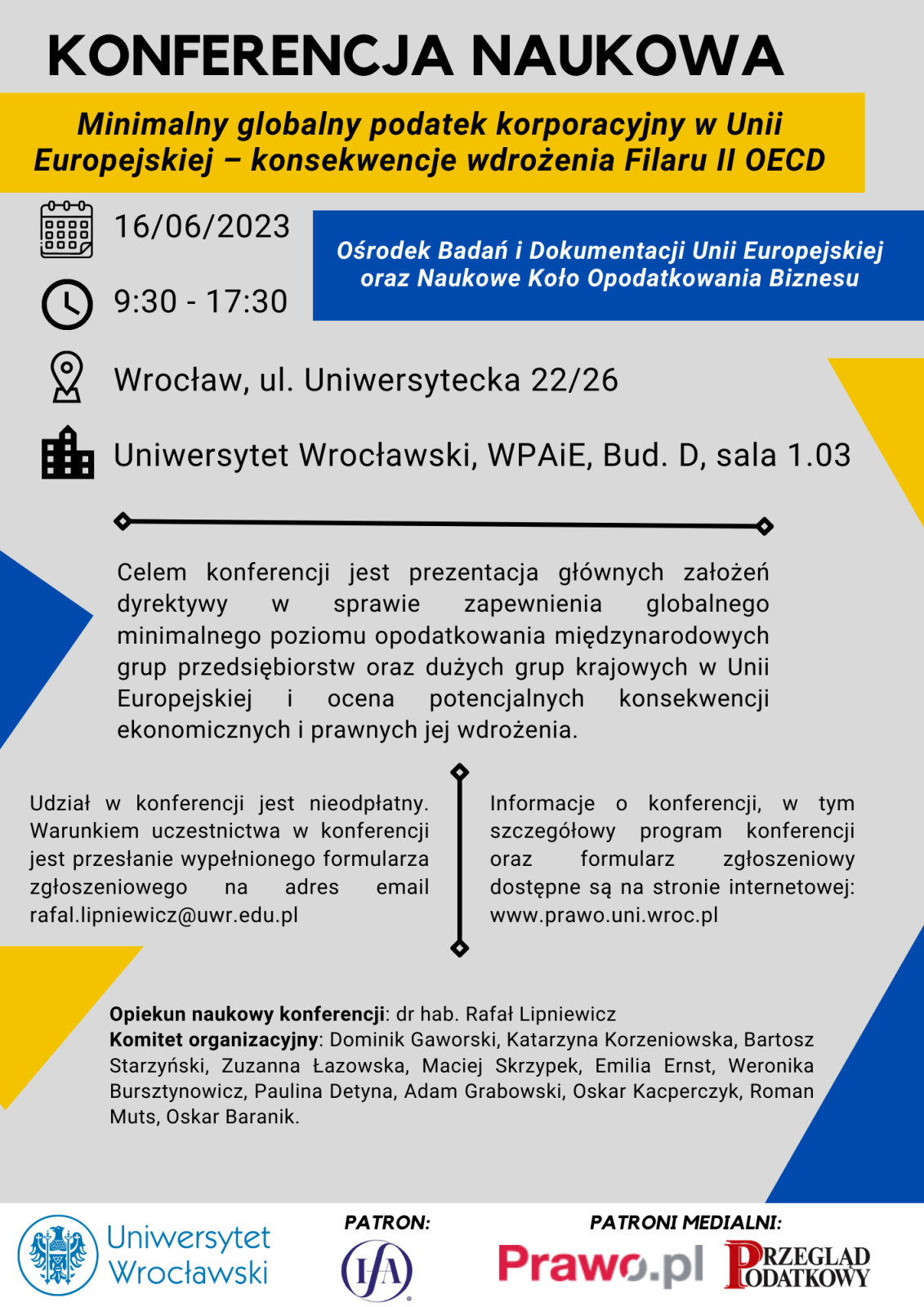

On 16 June 2023, the Faculty of Law, Administration and Economics of the University of Wrocław is organising a scientific conference Global Minimum Corporate Tax in the European Union – Implications of the implementation of OECD Pillar II. The aim of the conference is to present the main principles of Directive 2022/2523 on ensuring a global minimum level of taxation for multinational enterprise groups and large national groups in the European Union and to assess the potential economic and legal consequences of its implementation.

The conference programme includes three thematic panels. The first panel will present the assumptions and legal construction of the global minimum corporate tax, included both in the OECD model rules and in the provisions of Directive 2022/2523. The second panel will focus on the issues of implementation of the Global Minimum Tax Directive into the Polish tax system. The third panel will be a discussion on the potential effects of the implementation of the Global Minimum Corporate Tax in the European Union on the economy and business, including the impact on Poland’s investment competitiveness.

Speakers at the conference will be recognised representatives of tax advisory firms, government administration and academia. The conference is addressed to tax advisors, employees of financial departments of capital groups operating in Poland, the scientific community and all those interested in international business taxation.

The conference is held under the patronage of the International Fiscal Association – Polish Branch, while the media patronage is held by the Przegląd Podatkowy magazine and the prawo.pl portal. Information about the conference, including a detailed conference programme and registration form, is available on the website.